Market Review

Macroeconomic trends in the reporting year

Factors that determine the state of the Russian economy as a whole and have an impact on the electric power industry

Electricity generation by the UES of Russia power plants in 2024 totalled 1,180.7 billion kWh, up 4.1% year-on-year. The volume of electricity consumption within the UES of Russia in 2024 was 1,174.1 billion kWh, up 4.7% year-on-year.

As of year-end 2024, the average annual consumer price index stood at 108.5%, compared to 105.9% as of year-end 2023. The overall inflation rate for 2024 reached 9.52%, compared to 7.42% in 2023. According to the regulator’s projections, rate of price growth will stand at 7.0% in 2025.

Russia’s GDP for 2024 amounted to RUB 200 trillion. The index of physical volume of GDP relative to 2023 is 104.1%. The GDP deflator index for 2024 against 2023 prices was 108.9%. The industrial production index in 2024 compared to 2023 was 104.6%.

Another factor determining the state of the Russian economy as a whole and affecting the electric power industry is the Bank of Russia’s key rate, which rose by 5 points in 2024.

Forecast for ensuring sustainable development of the economy and the electric power industry in 2025

The forecast for social and economic development for 2025–2027 by the Russian Ministry of Economic Development takes into account the following trends:

- Higher global oil prices compared to the level projected in spring 2024

- Weakening of the rouble against foreign currencies

- Competition for personnel in the labour market and the associated growth in wages and cash income of the population

- Sustained investment activity

- Outpacing growth in manufacturing output, mainly driven by sectors focused on domestic demand (both consumer and investment ones)

As a result, growth estimates for GDP and a number of its components for the forecast period were improved. At the same time, estimates of cumulative GDP growth for

The primary driver of economic growth will be domestic demand, both consumer and investment, which will be satisfied through the development of the supply-side economy and the consistent achievement of the targets set out in Decree of the President of the Russian Federation No. 309 dated 7 May 2024 ‘On the National Development Goals of the Russian Federation until 2030 and Beyond to 2036. For the

Company’s position in the industry

GRI 2-6

The Company was included in the register of subjects of natural monopolies in the fuel and energy complex, which are subject to state regulation and control through setting tariffs for electricity transmission services and services for connection consumers to the electric power grids of the Company.

Since January 2025, PJSC Rosseti South has been operating as a systemic territorial grid organisation (hereinafter referred to as STGO). Since 2025, PJSC Rosseti South has been performing the function of STSO in four regions within its catchment area (in Astrakhanenergo, Volgogradenergo, Kalmenergo and Rostovenergo branches) for the period from 2025 to 2029.

The Company’s services are mainly consumed by electricity retailers, entities of the wholesale and retail electricity markets, and local grid operators.

Most of the electricity supplied to consumers within the service area of PJSC Rosseti South passes through the electric power grids of the Company.

In 2024, the total revenue of PJSC Rosseti South amounted to RUB 51,265 million, including 93.8% from electricity transmission, 1.9% from grid connection, 2.8% from electricity sales services, and 1.5% from other activities.

Data used:

Russian Statistics Agency website. Consumer Price Index

Russian Statistics Agency website. About the Consumer Price Index in December 2024

Website of the Bank of Russia. Macroeconomic Survey of the Bank of Russia

Website of the Bank of Russia. Key rate of the Bank of Russia

Website of the Bank of Russia. Inflation expectations and consumer sentiment

Website of JSC System Operator of the Unified Energy System

Branch | Total revenue, RUB million | Share in the total revenue, % | Grid-wide services (electricity transmission) | Share in the total value across Rosseti South, % | Grid-wide services (grid connection) | Total share across Rosseti South, % | Electricity and capacity resale | Total share across Rosseti South, % | Other services | Total share across Rosseti South, % |

|---|---|---|---|---|---|---|---|---|---|---|

Astrakhanenergo | 7,605 | 14.8 | 7,229 | 15.0 | 302 | 30.2 | – | 0 | 73 | 9.8 |

Volgogradenergo | 13,099 | 25.6 | 12,671 | 26.4 | 164 | 16.4 | – | 0 | 264 | 35.3 |

Kalmenergo | 3,323 | 6.5 | 1,804 | 3.8 | 49 | 4.9 | 1,421 | 98.0 | 48 | 6.5 |

Rostovenergo | 27,147 | 53.0 | 26,361 | 54.8 | 487 | 48.6 | – | 0 | 299 | 40.1 |

Kubanenergo | 61 | 0.1 | 0 | 0.0 | 0 | 0.0 | – | 0 | 61 | 8.1 |

Executive Office | 31 | 0.1 | 0 | 0.0 | 0 | 0.0 | 29 | 2.0 | 2 | 0.3 |

TOTAL | 51,265 | 100.0 | 48,066 | 100.0 | 1,002 | 100.0 | 1,450 | 100.0 | 747 | 100.0 |

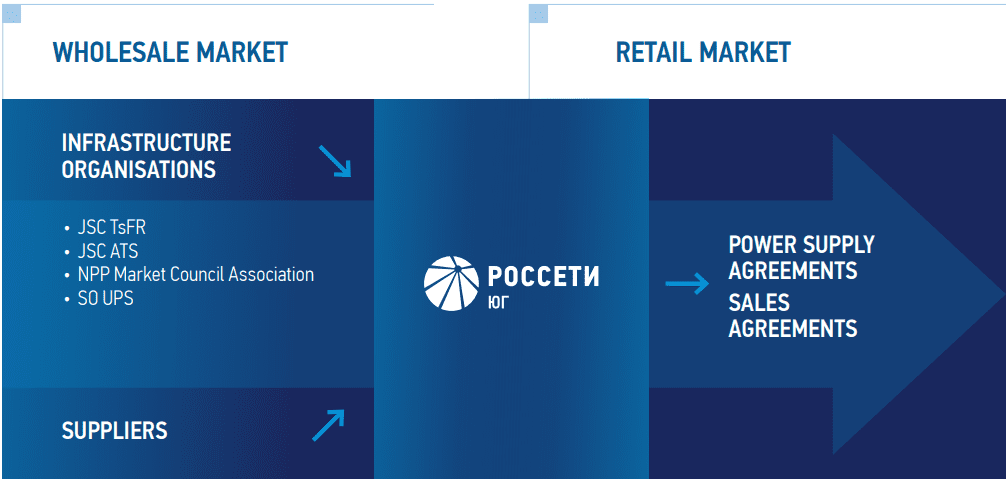

Liaison mechanism of PJSC Rosseti South acting as a guaranteeing supplier with entities of the wholesale and retail electricity (capacity) markets

Impact of external sanctions on the adjustment of the Company’s strategy

Due to the specifics of the Company’s operations, with services provided mainly to consumers in the domestic (Russian) market, the sanctions imposed by foreign countries did not have a direct and significant negative impact on the Company and its activities.

Main competitors of the Company

The Company’s competitors are relatively small TGOs within its catchment area. It is important to note that smaller competitors are at the local level, are tied to certain municipal districts, and have a little impact on the issuer’s business. The likely major competitors are JSC Donenergo in the Rostov Oblast, MUE Astrakhan Gorelektroset in the Astrakhan Oblast, CJSC Volgogradoblelectro in the Volgograd Oblast due to their coverage area and a single rate of grid connection tariffs. However, due to the existing division of territorial responsibility of TGOs in terms of providing services, including grid connection of consumers, the above-mentioned companies have extremely limited market power.

In addition, to measure the attractiveness of investing in shares of PJSC Rosseti South in the stock market, the Company is usually compared with other interregional distribution grid companies, although the legal entities are not competitors and, moreover, are subsidiaries of PJSC Rosseti.

The year-on-year decline in the share of PJSC Rosseti South is mainly driven by higher RGR on existing TGOs due to an increase in the number of conventional units of equipment. The lower share of PJSC Rosseti South in 2024 compared to 2023 was also a result of changes to the Guidelines on the use of actual CPI approved by Order of the Federal Tariff Service No. 98-e dated 17 February 2012.

In 2024, there were 45 TGOs operating in the regions serviced by PJSC Rosseti South. In 2025, following the entry into force of Federal Law No. 185-FZ dated 13 April 2024 and Resolution of the Government of the Russian Federation No. 184 dated 28 February 2015 ‘On the classification of owners of power grid facilities as territorial grid organisations’, 24 companies retained their TGO status.

The market share of PJSC Rosseti South in 2025 in the regions where it operates was 75.5%.